Irs Dependent Exemption 2024

Irs Dependent Exemption 2024. The irs defines dependents as qualifying children or. 2021, 2022, 2023, 2024, dependent, exemption, irs.

Your exemption amount for figuring the alternative minimum tax is half that allowed on a joint return. The irs defines dependents as qualifying children or.

Tax Credits And Deductions Change The Amount Of A Person's Tax Bill Or Refund.

Page last reviewed or updated:

The Standard Deduction Rules Are Different If You Can Be Claimed As A Dependent On A Federal Tax Return.

A tax dependent is a qualifying child or qualifying relative who fits certain criteria.

A Dependent Is A Qualifying Child Or Relative Who Relies On You For Financial Support.

Images References :

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Taxpayers with dependents who don't qualify for the child tax credit may be able to claim the credit for other dependents. Personal and dependent exemptions are no longer used on federal tax returns, having been suspended in the 2018 tax year by the internal revenue service.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, The irs defines dependents as qualifying children or. The irs dependent exemption in 2023 and 2024 is aimed at taxpayers who need to pay for dependents.

Source: dolliqjuieta.pages.dev

Source: dolliqjuieta.pages.dev

Tax Brackets 2024 Irs Single Elana Harmony, The irs defines dependents as qualifying children or. Tax credits and deductions change the amount of a person's tax bill or refund.

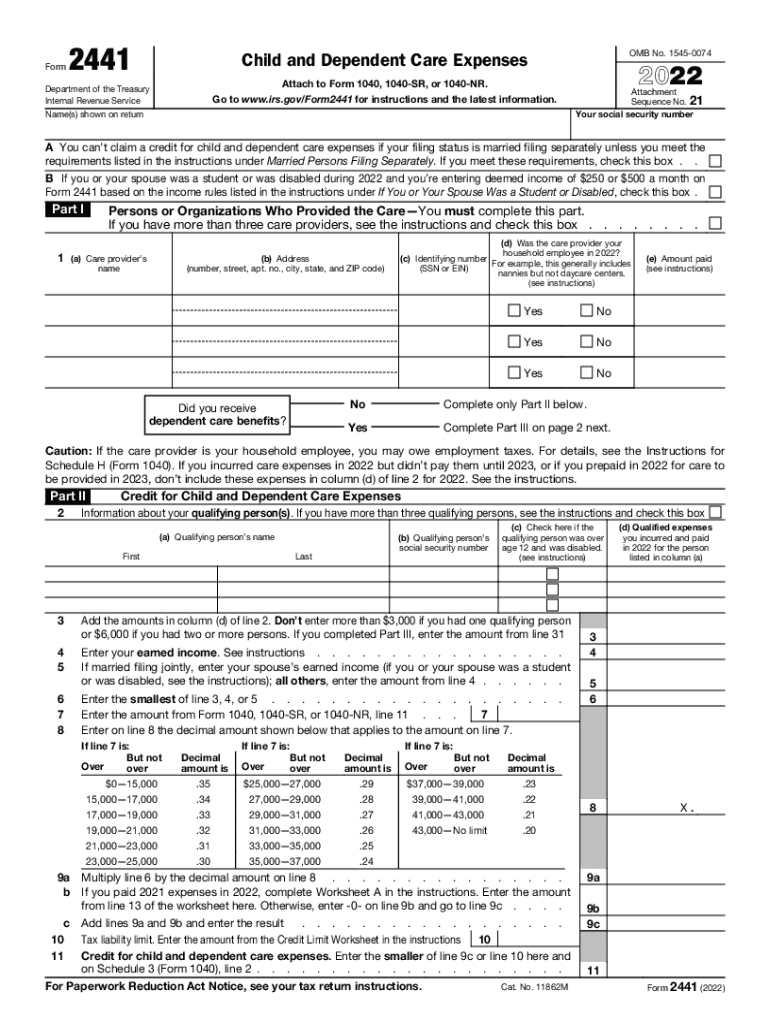

Source: www.signnow.com

Source: www.signnow.com

Child and Dependent Care Credit 20222024 Form Fill Out and Sign, Child and dependent tax credit: You were generally allowed one exemption for yourself (unless you could be claimed as a dependent by another taxpayer), one exemption for your spouse if you filed.

Source: suellenwcris.pages.dev

Source: suellenwcris.pages.dev

Irs 2024 Schedule A Worksheet Inge Regine, A tax dependent is a qualifying child or qualifying relative who fits certain criteria. For the tax years 2023 and 2024, each dependent's exemption.

Source: www.youtube.com

Source: www.youtube.com

How to fill out the IRS Form W4 2023 YouTube, If you have one child and your adjusted gross income was $46,560 (filing alone) or. If you pay for care for a dependent while you work then those expenses can qualify you for a credit worth up to $3,000 for one dependent and $6,000 for two or more.

Source: www.youtube.com

Source: www.youtube.com

What is the IRS Dependent Exemption for 2020, 2021? YouTube, If you adopt a child, you may qualify for the adoption tax credit, a nonrefundable tax credit that allows you to claim a credit of up. By knowing the eligibility criteria and navigating the rules for dependent exemptions, families can make the most of available tax benefits and achieve greater financial stability.

:max_bytes(150000):strip_icc()/2023FormW-4-64302bb2a6504482bab1e847bbc4cb1a.jpg) Source: www.investopedia.com

Source: www.investopedia.com

Form W4 What It Is and How to File, Citizens and permanent residents who work in the united states need to file a. For 2023, the standard deduction for dependents is limited to the greater of $1,250 or your earned income plus $400—but the total can’t be more than the normal.

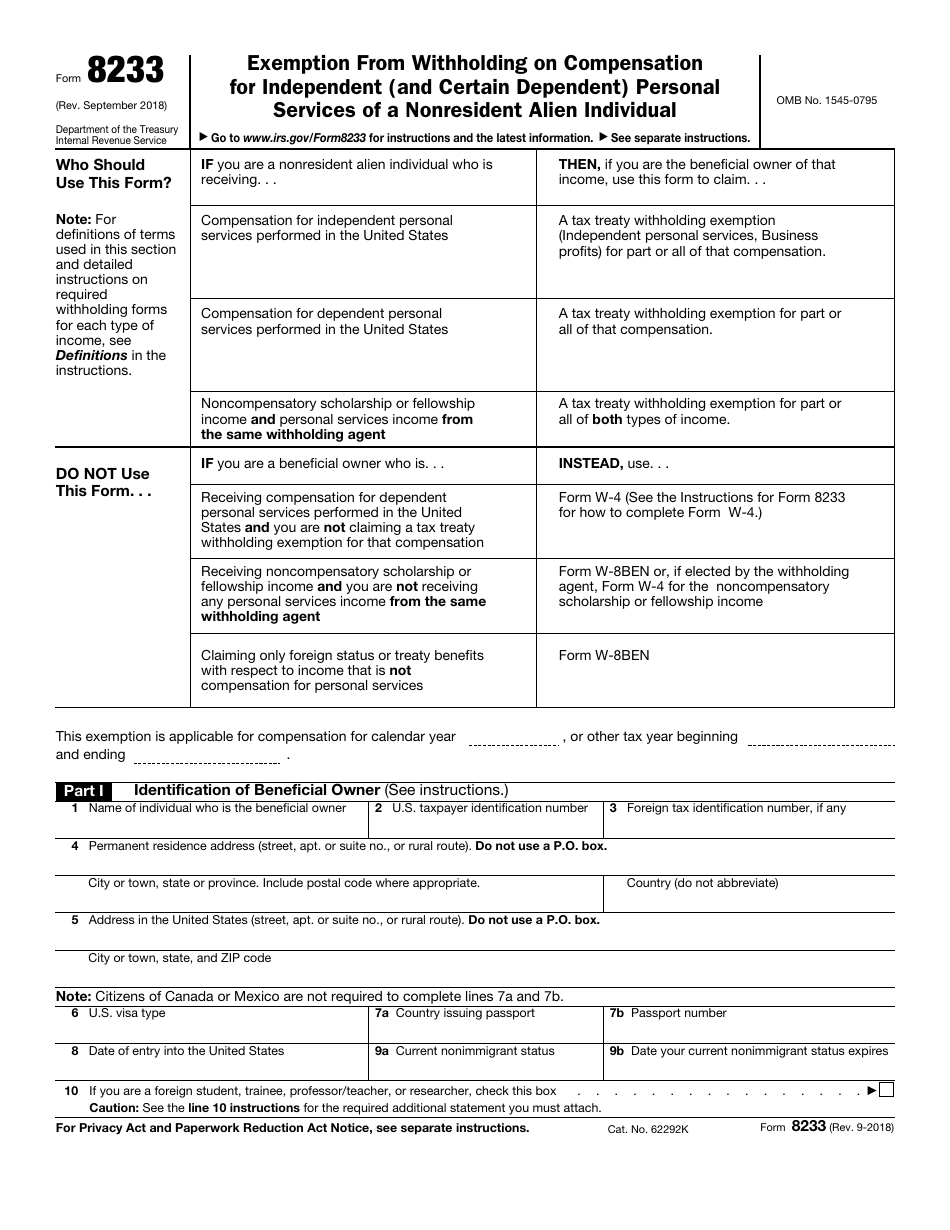

Source: www.templateroller.com

Source: www.templateroller.com

IRS Form 8233 Download Fillable PDF or Fill Online Exemption From, People should understand which credits and deductions they. For the tax years 2023 and 2024, each dependent's exemption.

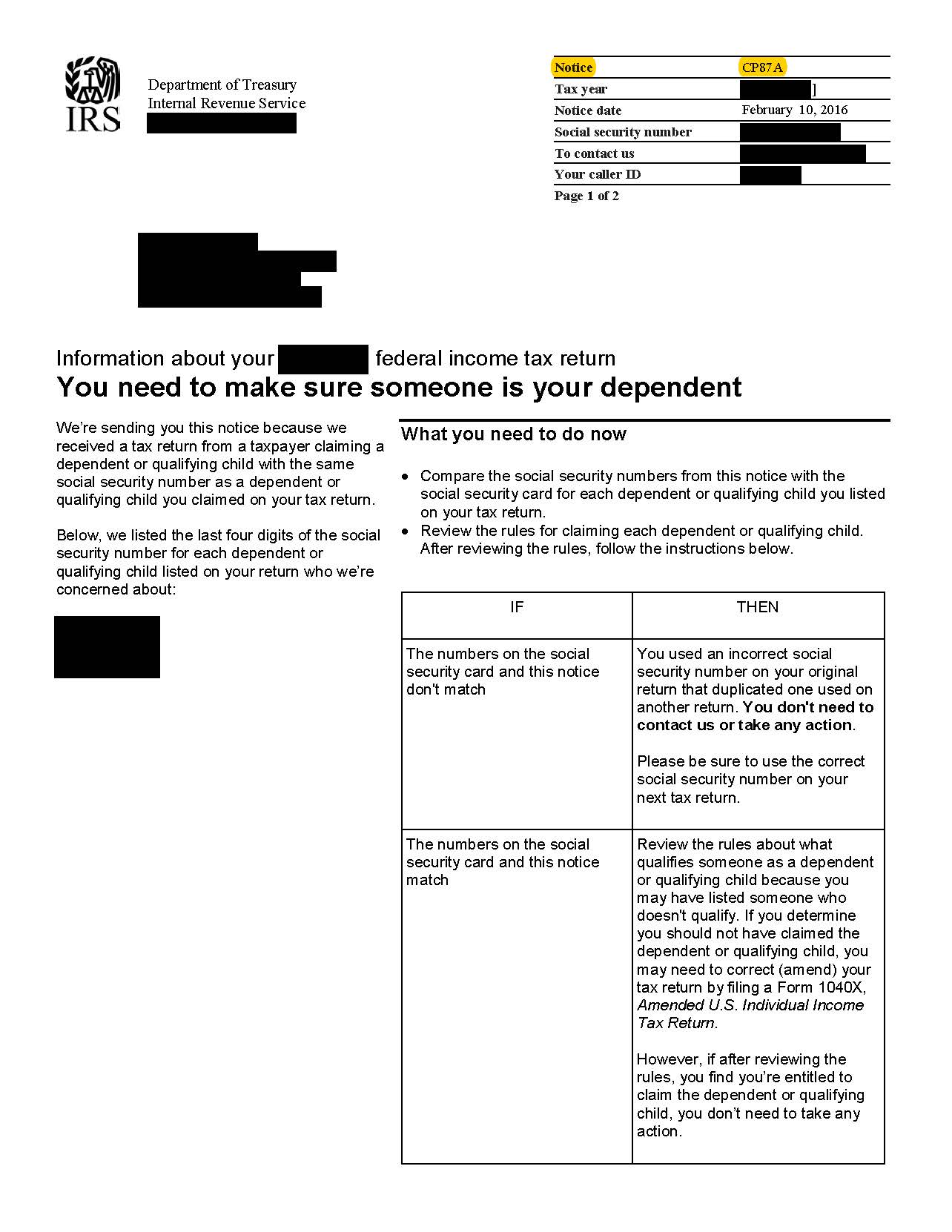

Source: taxhelpaudit.com

Source: taxhelpaudit.com

Notice CP87A from the IRS Tax Attorney Steps, Personal and dependent exemptions are no longer used on federal tax returns, having been suspended in the 2018 tax year by the internal revenue service. This elimination of the personal exemption was a provision in the tax cuts and jobs act.

Having A Child Could Make You Eligible For The Earned Income Tax Credit.

Key highlights of irs dependent exemption for 2023 and 2024 include:

2021, 2022, 2023, 2024, Dependent, Exemption, Irs.

By knowing the eligibility criteria and navigating the rules for dependent exemptions, families can make the most of available tax benefits and achieve greater financial stability.